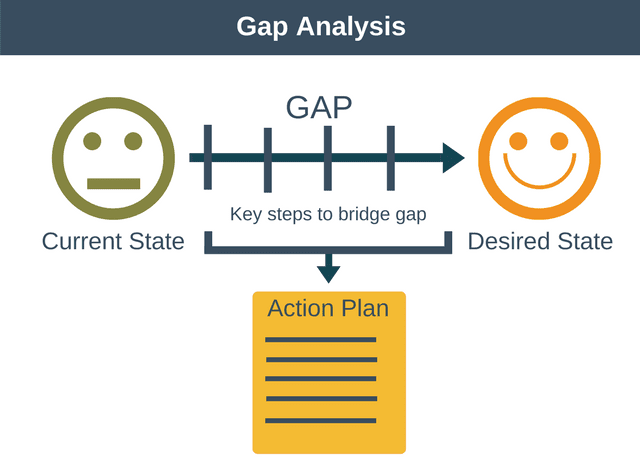

Gap analysis involves the comparison of actual performance and the desired or potential performance of a business. The resultant GAP is the reason to the name of ‘GAP Analysis’. The gap analysis examples can help you create a better understanding of how you can compete with the competitors. Gap analysis actually looks at the optimum resource allocation level and the current resource allocation level, and this can disclose areas which need betterment.

GAP analysis and GAP analysis examples

The first step in performing a GAP analysis is to closely examine the company’s core goal and vision. This then helps in setting targets accordingly. These targets are the ideal business positions where the business wants or expects to be in the future. The next step is to examine what is currently happening in the business. The current allocation of resources, performance, and processes get an evaluation through several sources. The sources include company records, taking employees’ interviews and observing business activities. Then, the business can compare its current performance with the goals it has already set by examining the business’ vision.

The ‘gap’ which arises from this comparison can now become a target. The fulfillment of this target can happen by appropriate resource allocation plans, hard work, and commitment. The GAP analysis application can happen in any department of a business including finance, human resources, marketing and so on. Each department will have their own set goals which they will compare with the actual position of the business. This will help in realizing the gap and the reasons for that gap. The management takes necessary measures to eliminate those gaps.

Tools for bridging the GAP

The bridging of the GAP can be an irksome job, but there are several tools that can make this easy. These tools include the SWOT analysis, PEST analysis and McKinsey 7S Framework and so on. GAP analysis examples can actually help business use the right combination of tools.

SWOT Analysis

The SWOT analysis analyses business’ strengths, weaknesses, opportunities and threats. The strengths of a business are the good things about it through which it can beat its competitors. They may include the brand image, loyal customer base and unique selling proposition of the business. On the other hand, weaknesses are the bad things about a business or the advantages the competitors have over the business and they include high costs, negative consumer feedback and so on. The opportunities of a business include external chances on which the business can cash on to gain benefits and they can even opt for diversification. Threats are external factors which can harm your business in some way and they might include international competition, propagandas against the business, climate changes and so on.

PEST Analysis

The PEST analysis looks at the external factors that can influence the business. Those factors are: political, economic, social and technological. These factors can affect the business either adversely or positively. It totally depends on how the business managers manage them.

7S

The McKinsey 7S Framework analyses whether the business is meeting its expectations or not. It works with the 7 S’s of a business which are structure, strategy, systems, shared vision, skills, style, and staff.

Gap Analysis Examples

Dealing with Customer Satisfaction

One of the gap analysis examples is of an airline company. The company might look at the gaps between its current position and the desired position it had set some years ago. The gaps may have been because of a lack of customer satisfaction. The aim of the management is to maximize customer satisfaction, but the target may have been out of reach. Now, the gap has a chance for a fulfillment through continuous work towards customer satisfaction. The company may use PEST analysis to see whether any external factors are influencing their goal of providing customer satisfaction, and if there are, they need dealing, appropriately.

Dealing with order fulfillment

Another gap analysis example might be of a car manufacturer to see why are so many orders of cars unfulfilled. The management would have found many gaps (reasons of delay in orders) which might include faulty assembly plants, labor going slow deliberately as a union act, distracting activities while work including mobile phones and any activity which might be the reason of the slow pace of entire process. All these gaps would be bridged through necessary corrective measures.

Addressing low sales

Another gap analysis example is of a departmental supermarket. These supermarkets have different compartments for different types of goods. The supermarket, probably, may be facing an issue of lower sales than the expectations. Consequently, upon doing the gap analysis, the management may find several gaps due to which this low sale might be occurring. These gaps may include problems such as wrong setting of goods on the supermarket shelves, lousy staff which is not helping customers find the goods they are looking for. Further more, no banners of department names, prices not put on the goods and less variety of brands available at the supermarket can also be the reason. These gaps can also be taken care of if necessary corrective measures are taken.

Tackling poor cashflows

Last gap analysis example we will quote is about a packaged snacks company. The company might be facing a bad cash flow and can be on the verge of bankruptcy. Upon performing the gap analysis, the company may find problems:

- Fewer promotions given

- wrong and inefficient supply channels,

- High prices in comparison to competitors

- Creditors given relaxation in paying back the amount they owe

All these problems are solvable if correct measures are taken.

All these GAP analysis examples have some things in common. Once the goal setting in an organization happens, the gap analysis is done by taking the current performance of the business into consideration. GAP identification is done by comparing the expectations of the performance to the actual performance. Lastly, necessary steps are taken to bridge the gap which is due to the inconsistency between the actual and planned performance of the business.